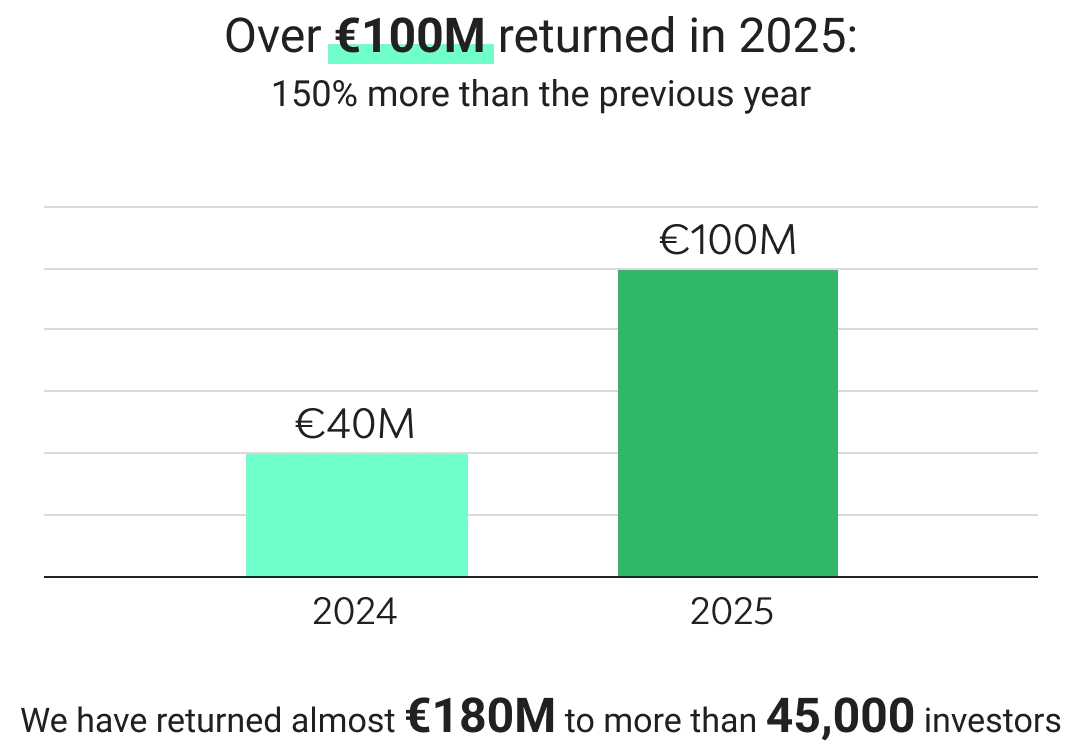

In 2025, Urbanitae returned just over 100 million euros to its investors, exceeding the previous year's results by nearly 150%.

In total, we have returned more than million euros to over investors. These figures clearly demonstrate the profitability Urbanitae can offer and the rigour with which we select investment opportunities with the best combination of return and risk.

The projects returned by Urbanitae include both debt and equity operations, with average return periods of 29 and 13 months respectively.

If we consider the projects that have been fully returned – those that have already finished – we are looking at an average annual return (IRR) of over . None of them has resulted in a loss for the investor.